Management Study Program Holds Guest Lecture in Financial Management: Transformation in Banking

The Management Study Program, Faculty of Economics and Business (FEB) Universitas Sebelas Maret (UNS) Surakarta, held the second part of the Guest Lectures series in the 2021 Program Kompetisi Kampus Merdeka (PKKM) entitled “Financial Management: Transformation in Banking” on Tuesday (19/10/2021).

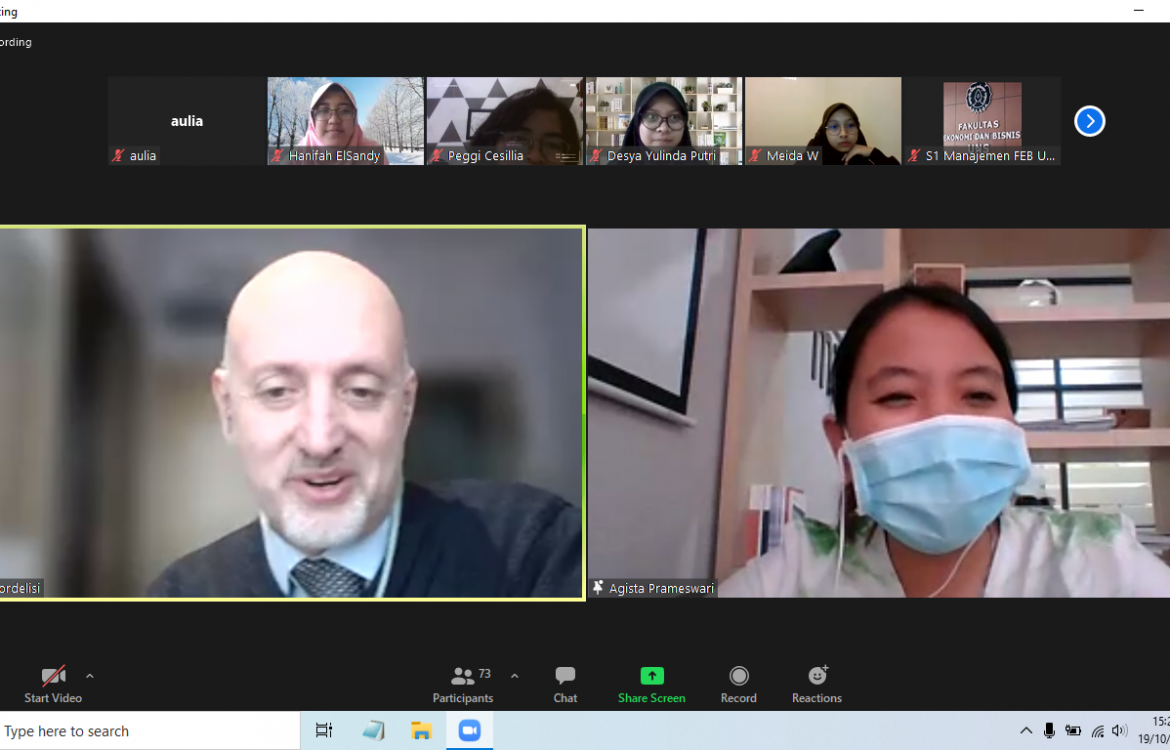

The Guest Lecture with Prof. Franco Fiordelisi was held virtually through the Zoom Cloud Meeting and was attended by around 70 participants consisting of students and lecturers from FEB UNS.

Before starting his material presentation on Liquidity Risk in the Banking sector, Prof. Fiordelisi expressed his hope to visit UNS directly. “I hope to be able to visit UNS in person because your university has interesting stories and facilities,” said Prof. Fiordelisi.

As part of the Guest Lecture series on financial management, the material presented by Prof. Fiordelisi in this guest lecture aims to help students in understanding how banks are managing their sources of liquidity risk.

The material is started with the definition of liquidity from three different views, namely the securities, markets, and financial liquidity. Liquidity viewed from the security instrument refers to the condition where a security instrument can be traded easily in the capital market.

On the other hand, a market (stock/capital market) is considered liquid when there is a good or balanced level of demand and supply. On the other hand, financial liquidity is a condition where a financial instrument can be used to obtain funding or to pay off obligations. Hence, it can be concluded that, in general, liquidity can be defined as the number of assets that can be immediately used in transactions.

In relation to banking institutions, Prof. Fiordelisi mentioned that banks are the only institutions dealing with tremendous liquidity pressures due to their obligation to maintain customer trust.

According to him, banks must be able to manage liquidity well to ensure that customers can withdraw funds for their daily needs.

Liquidity risk can occur under two types of circumstances, a result of specific events or due to systemic conditions. Specific events liquidity risk normally occur due to internal conditions of the bank or a specific event happened, for example, debtors that fail to settle periodic installments, which then disrupts the bank’s liquidity level. This condition, according to Prof. Fiordelisi, requires more attention from bank managers.

Liquidity risk can occur under two types of circumstances, a result of specific events or due to systemic conditions. Specific events liquidity risk normally occur due to internal conditions of the bank or a specific event happened, for example, debtors that fail to settle periodic installments, which then disrupts the bank’s liquidity level. This condition, according to Prof. Fiordelisi, requires more attention from bank managers.

On the other hand, liquidity risk due to systemic conditions usually occurs in other banking institutions but has a systemic impact on a country’s financial system. “Although this systemic condition does not actually involve the concerned bank, such condition could affect customer confidence in the banking sector as a whole. Therefore, managers still have to pay attention to this systemic condition in making decisions,” explained Prof. Fiordelisi.

The topic of discussion continues to the types of calculation approaches in liquidity risk management, which consist of a stock-based approach, cash flow, and hybrid. The discussion is closed with the explanation of various regulations in the banking sector, which are globally regulated by the Basel Committee on Banking Supervision within the Basel III provision.

Reporter: Aulia

Editor: Humas FEB