The Management Study Program Discusses Financial Risk in Basic Financial Management Guest Lecture

Decisions on financial investment cannot be separated from the calculation of interest rates, risks, and inflation. However, in conducting financial management, there are many other aspects that need to be considered by students majoring in business and economics as potential investors and entrepreneurs.

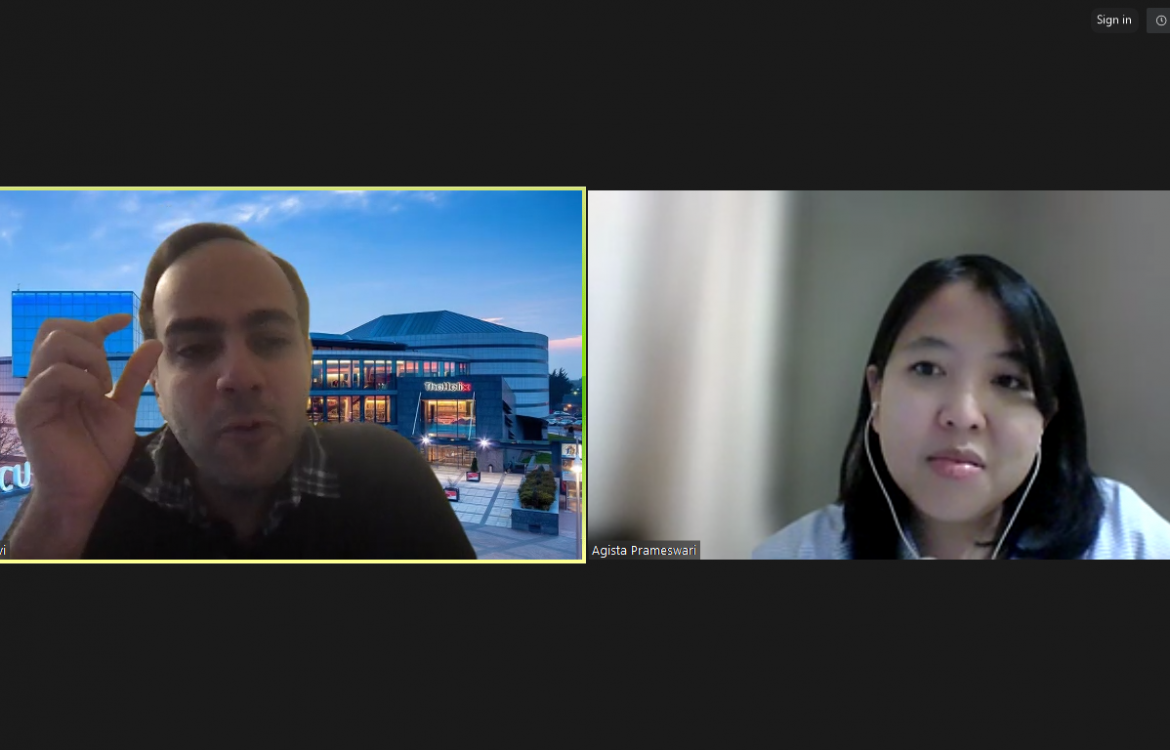

Responding to this challenge, the Management Study Program, Faculty of Economics and Business (FEB), Universitas Sebelas Maret (UNS) presented a guest lecture entitled ‘Basic Financial Management,’ by inviting Dr. Aref Mahdavi Ardekani, from Dublin City University, Ireland as a guest lecturer.

In the guest lecture, Dr. Arev presented a material entitled ‘Risk, Return and the Historical Record,’ which began with topics related to currency values and inflation rates.

“In financial management, we learn that the value of the currency we have today will not be the same as the value of money in the future. For example, if we keep our money in the bank or lend our money for business activities, then in the future we can get a higher return than the current value of our money,” he explained.

Furthermore, Dr. Arev presents an analogy that the interest rate applicable in a country is similar to the price of renting goods. When there are many items for rent, the price or cost of renting them will be lower, and vice versa. The same law applies to interest rates, “when the value of money available for borrowing is limited, the interest rate will be higher, and vice versa.”

In this regard, there are generally four factors that affect interest rates, namely the supply of funds from customers’ savings/deposits, requests for funding from businesses, the level of demand for funds (financing) from the government, and inflation rate predictions.

In addition to discussing inflation and interest rates, Dr. Arev also takes on the topic of risk levels and returns, which include sources of investment risk, risk calculation ratios, and returns, as well as the use of Sharpe ratios in assessing the performance of investment portfolios.